2025 Missouri Tax-Free Weekend Sales Guide: Back to School Sales

Families continue to spend more and more on Back to School shopping, so you need all the savings you can get…

Since we buy so much when school starts back up, save big at Back to School Sales during Missouri Tax-Free Weekend 2025! Get this on your calendars and save, save, save!

If you have back-to-school shopping to do…this is the time to do it. If you live in Kansas, just head over the state line! You don’t need to be a Missouri resident for big back-to-school savings. Be sure to check out our other guides to savings: Local Deals & Steals and also our Birthday Freebies Guide

This year, Missouri’s tax-free weekend runs from August 1st-August 3rd, 2025. So, stock up on back-to-school supplies, school clothing computers, shoes & other items exempt from sales tax.

You can shop most things for Back to School sales tax-free!

When are Missouri Tax-Free Weekend Sales 2025?

The 3-day sales tax holiday begins Friday, August 1st at 12:01 am, running through Sunday, August 3rd at midnight. So, if you’re heading out for back-to-school shopping…this is the time to do it.

Every year, the Missouri sales tax holiday is held from the first Friday of the month through that Sunday night. Mark this weekend on your calendar. Circle, highlight & star this Tax-Free Weekend!

What’s Included in Tax-Free Shopping?

You can shop at any store located in Missouri, but only certain items are included in the tax break. See below for a full list of what is included in the Back to School Tax-Free Weekend.

There are some cities and counties opting out of the tax holiday, so, check which cities opted out before you head out to shop.

According to the state of Missouri, “If one or all of your local taxing jurisdictions are not participating in the sales tax holiday, the state’s portion of the tax rate (4.225%) will remain exempt for the sale of qualifying sales tax holiday items.”

The Rules:

Back to School, Tax-Free Weekend is limited to personal items related to Back to School season. Items like back-to-school shoes, clothing, school supplies & computers are all included. Here is a full list of tax-exempt items for 2025:

- Back to School Clothing – any article having a taxable value of $100 or less

- School supplies – not to exceed $50 per purchase

- Computer & technology software – taxable value of $350 or less

- Personal laptops/computers – not to exceed $1,500

- Computer peripheral devices – not to exceed $1,500

- Graphing Calculators – not to exceed $150

Back-to-school clothing is considered any article of clothing to be worn on your body. This INCLUDES DIAPERS for babies, as well as footwear.

Back-to-school clothing does NOT include watches, jewelry, purses, scarves, ties, headbands, belt buckles & umbrellas. The official, state definition of clothing is, “any article of wearing apparel intended to be worn on or about the human body including, but not limited to, disposable diapers for infants or adults and footwear. The term shall include but not be limited to, cloth and other material used to make school uniforms or other school clothing. Items normally sold in pairs shall not be separated to qualify for the exemption.

School supplies are considered items used in standard classrooms for educational needs including notebooks, textbooks, paper, art supplies, pens & pencils, backpacks & book bags, calculators (including graphing & handheld), chalk, & globes. This does NOT include radios, headphones, phones, office equipment, furniture, or sporting equipment.

** Graphing calculators must be $150 or less and computer software less than $350. If prices go over, you will only have to pay tax on the overage.

This Missouri tax-free weekend applies to state & local sales taxes when they choose to participate. You can find a complete list of cities not participating online.

If you are a teacher, you can also purchase school supplies for your classroom during the Back to School Tax-Free Weekend.

Can I Buy Tax-Free Online?

You can make tax-free purchases online as long as the purchase is completed in the 3-day tax-free period. Keep in mind that your shipping cost will be included in the price restraints listed above. If you go over the limit, you will have to pay tax on anything above the limit. Don’t forget to factor it in!

All payments must be made before Sunday at midnight. You cannot put the items on layaway or payment plans that end outside the window. Purchases must be fully completed by the end of the weekend.

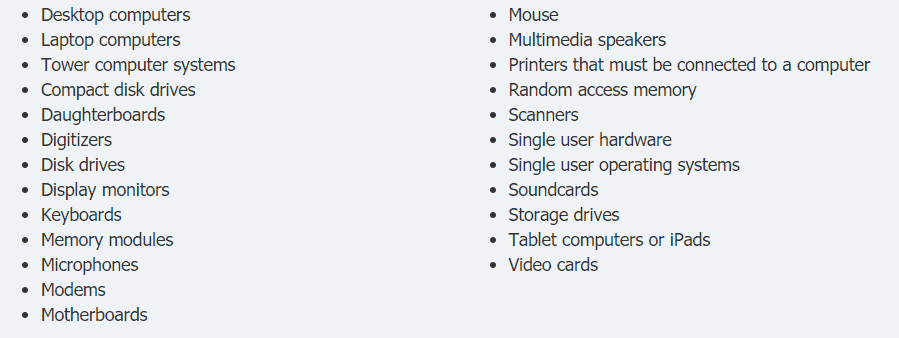

What Computers & Accessories are Included in Back to School Tax-Free Weekend Sales?

Personal computers included in the tax-free weekend are laptops, desktops, or tower computers (CPU, RAM, display monitor & keyboard).

The official definition of a personal computer is, a laptop, desktop, or tower computer system which consists of a central processing unit, random access memory, a storage drive, a display monitor, a keyboard, and devices designed for use in conjunction with a personal computer, such as a disk drive, memory module, compact disk drive, daughterboard, digitizer, microphone, modem, motherboard, mouse, multimedia speaker, printer, scanner, single-user hardware, single-user operating system, soundcard, or video card;

If you aren’t a computer wiz, here is a full list of what is considered “personal computers & computer peripheral devices”:

You can find more specifics on what is exempt during the sales tax holiday in Section 144.049, RSMo.

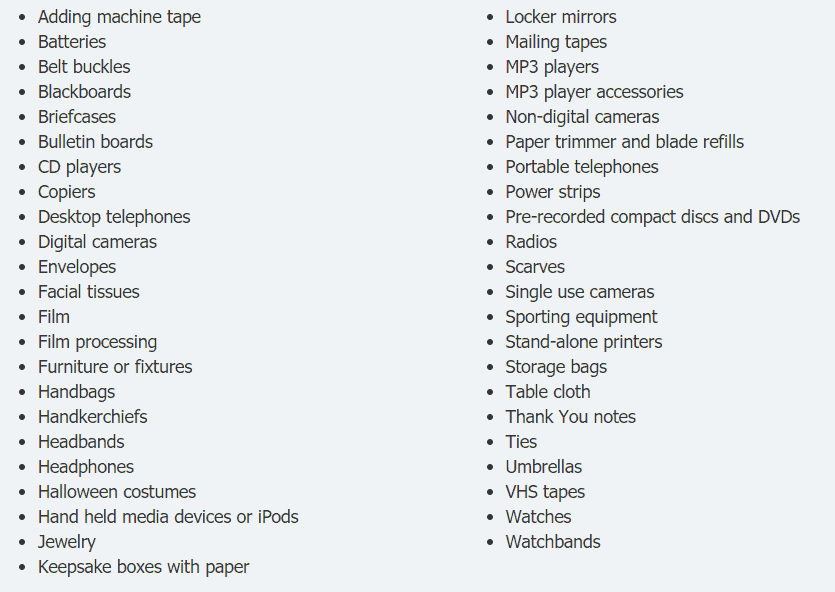

What Items Aren’t Included in Tax-Free Weekend Sales?

There are a wide variety of items that aren’t included in Missouri Tax-Free Weekend. There are honestly too many to list, but below is a list of items that are NOT included in the sale that may get confused with things potentially included in the Back to School Sale:

If one or all of your local taxing jurisdictions are not participating in the sales tax holiday, the state’s portion of the tax rate (4.225%) will remain exempt for the sale of qualifying sales tax holiday items.

You can find Tax Free Weekend Guidelines straight from the Missouri Department of Revenue for more info. Find the consumer guides or FAQs too.

For more helpful tips & money-saving info, sign-up for The Scoop!

From our family to yours, iFamilyKC